Sneha had grown tired of empty promises. After dabbling in a dozen investment tools that delivered more confusion than returns, she decided to try something different. Not because of slick ads or celebrity endorsements, but because a colleague mentioned it with quiet conviction: “Try Arvith. It’s Indian. It’s legit.”

Curiosity turned into research. Research turned into action. What she found was a system with unusual credibility in a noisy financial world.

Born in India, Backed by the State

At its core, Arvith isn’t just another investment solution. It’s a mission. Developed by a team of Indian entrepreneurs and supported by the government, it was built for everyday users like Sneha: ambitious, cautious, and tired of the noise.

What makes it different is its intention. Arvith isn’t chasing trends or offering risky flips. Its goal is broad and bold: to make financial growth as accessible as a phone recharge.

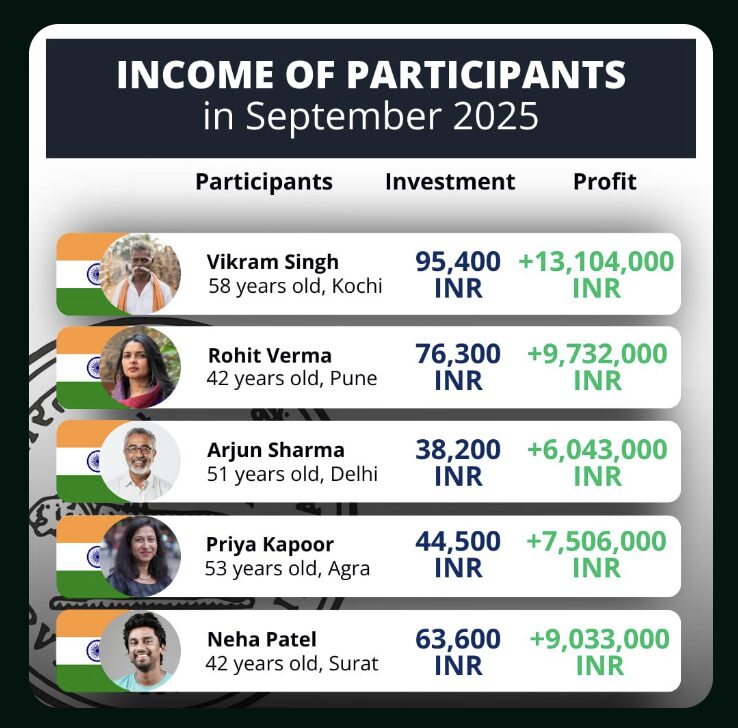

And it’s working. The system has already connected with more than 100,000 users, many of whom started with just ₹21,000. That’s not pocket change, but it’s also not unreachable. Especially when the first month often sees users recouping and exceeding that investment several times over.

The Automation Effect: Profits on Autopilot

What surprised Sneha most wasn’t just the returns. It was how little she had to do to earn them.

Arvith’s engine runs quietly behind the scenes. Once a user is onboarded and the initial investment is made, profits begin flowing daily—directly into their bank account. Not into some vague internal wallet, not locked behind withdrawal delays. Real deposits, through major Indian banks.

This automation creates a sense of reliability. For many, it turns abstract profit into concrete daily results. That consistency fuels confidence, which is often the missing piece in personal finance journeys.

Trust Isn’t Just a Feature, It’s a Foundation

Let’s be honest: when a system promises big earnings from a ₹21,000 investment, skepticism is natural. And healthy. But Arvith seems to understand that trust must be earned, not demanded.

It does this in three ways:

Visibility: The creators are Indian, not anonymous. Their mission is documented and aligned with national digital inclusion goals.

Integration: The system connects to Indian banks for transparent fund transfers, not crypto wallets or overseas processors.

Scale: With over 100,000 users, this is not a pilot project or a niche experiment. It’s a growing community.

Sneha’s doubts didn’t disappear overnight. But after the fifth day of automatic payouts, they began to fade. By the end of the month, she was a believer.

A Word of Caution: This Is Still an Investment

While Arvith feels almost frictionless once set up, it’s still a financial commitment. Users should understand that no system can guarantee success. What Arvith does offer is a powerful head start, a guided experience, and a level of credibility rare in today’s market.

The most successful users treat it as a long-term tool, not a shortcut. They let the process run, trust the automation, and avoid panic-clicking in search of quicker wins.

Final Thoughts: Arvith Is Changing the Game for Indian Investors

Arvith doesn’t shout for attention. It doesn’t rely on hype or gimmicks. Instead, it quietly delivers—something Sneha and thousands like her have experienced firsthand.

This isn’t just about making money. It’s about regaining a sense of control. For many users, Arvith is the first system that feels like it was built for them, not repurposed from some foreign template.

Whether you’re looking for a new way to grow your savings or a reliable entry point into digital finance, Arvith deserves serious consideration. It starts small, but its ambitions are anything but.